.jpg)

For many patients, dental care can be confusing. This confusion often arises not from the treatments themselves, but from the terms found on their insurance card. Words such as co-pay, deductible, coinsurance, and premiums may seem unfamiliar. These terms, though often confusing, refer to simple and clear concepts. Understanding how these costs relate to one another helps you manage your care effectively. Instead of facing unexpected charges at the dentist’s office, you can approach your visit with confidence and clarity.

This article explains the key elements of co-pays and deductibles in dental insurance. It also describes how these costs interact, the role of preventive care, and why a clear understanding can protect you from unforeseen expenses.

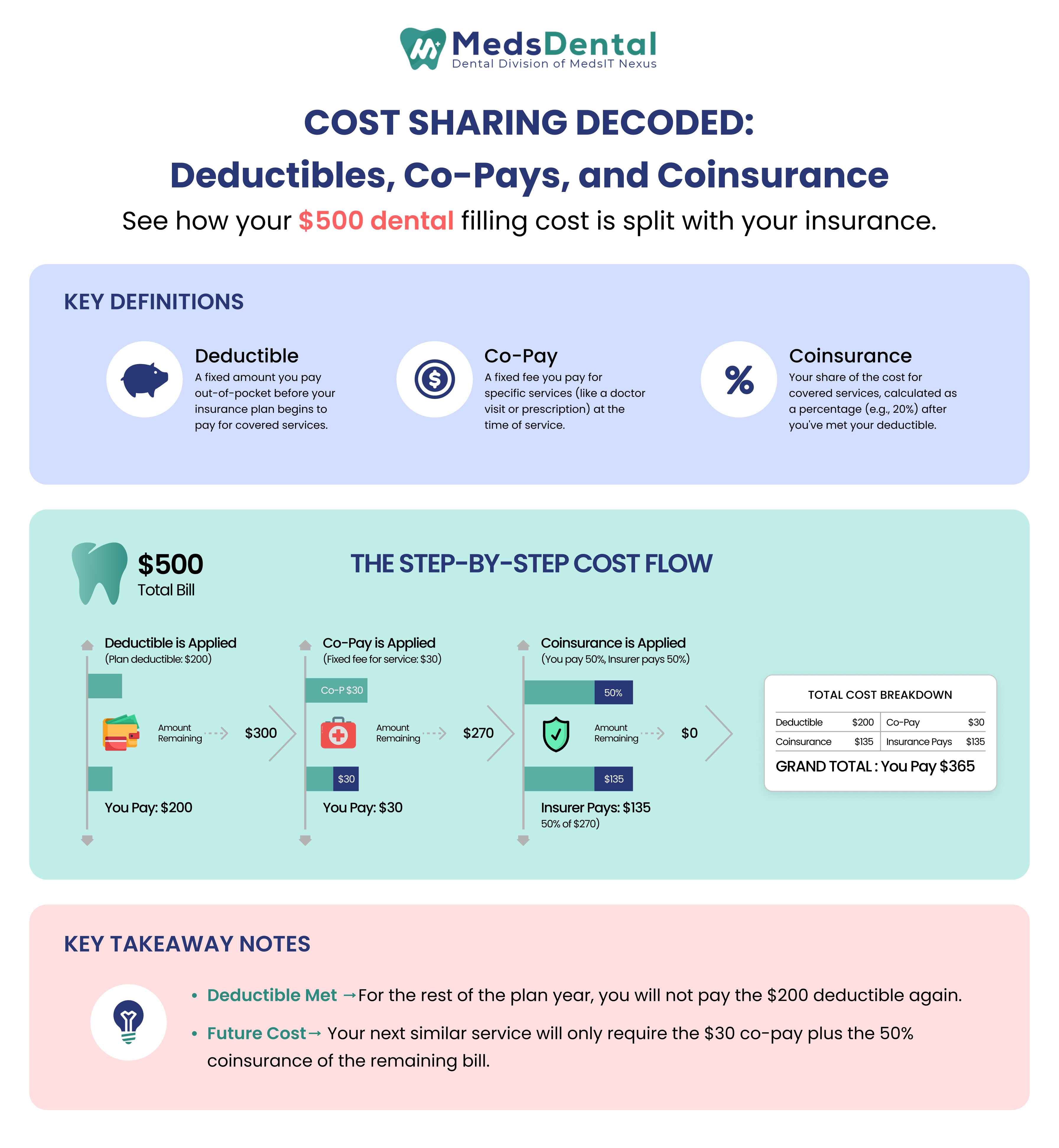

Among insurance terms, deductibles and co-pays represent the most common out-of-pocket expenses for patients. A deductible is the amount you must pay before your insurance begins to contribute toward the cost of covered services. A co-pay is a fixed fee you pay at the time of receiving specific treatments or examinations.

You can think of the deductible as an initial threshold that must be reached before your insurance coverage activates. Until this amount is met, the insurance provider does not share in the costs. The co-pay, in contrast, functions like a standard fee required each time you visit the dental office. While both involve cost sharing, they apply at different stages in the course of your care.

To better understand what a dental co-pay covers, consider these key points:

A co-pay, often written as co-payment, is predictable.

You know it in advance, and it does not usually change with the size of your treatment bill.

For instance, you may have a twenty-dollar co-pay for a check-up.

Whether your dentist performs a simple cleaning or includes fluoride treatment, your share at the front desk stays the same.

Dental co-pays are usually charged for basic visits, cleanings, or exams.

They do not replace your deductible.

Even after meeting your deductible, you may still owe a co-pay for certain services.

That makes them one of the easiest but most persistent out-of-pocket costs.

A deductible is less predictable than a co-pay. Instead of paying it per visit, you pay toward it until you reach a total amount in a given year. Only then does your plan step in to share costs.

Imagine a deductible of five hundred dollars. If you need a crown that costs six hundred, you pay the first five hundred, and the insurance pays part of the remaining one hundred. Once your deductible is satisfied, the insurer begins to share expenses on additional treatments that year.

Deductibles matter most for restorative or advanced care, such as fillings, extractions, or root canals. Preventive services often bypass them entirely.

Coinsurance introduces another additional key component to how costs are shared. Unlike co-pays, which are flat amounts, coinsurance is a percentage of the bill you share with your insurer after your deductible is met.

The short answer is no. In many cases, your co-pays stand alone and do not reduce the deductible balance. You might pay a fifteen-dollar co-pay for a cleaning, but that payment may not count toward your deductible requirement for a root canal later in the year.

Some plans treat things differently, which is why reading plan details is important. For patients, this distinction is often the most confusing part of insurance. Knowing whether co-pays help you reach your deductible can make budgeting far more accurate.

While co-pays and deductibles are important, several other factors also impact your overall costs. These often-overlooked elements include:

Premiums: The monthly amount you pay to maintain your insurance coverage.

Annual Maximums: The total amount your insurance will pay in a year before you cover all costs yourself.

Waiting Periods: Time frames before certain benefits become available under your plan.

Provider Networks: Restrictions on which dentists or specialists you can see for full coverage.

Frequency Limits: How often you can receive specific treatments, such as cleanings.

Exclusions: Procedures not covered by your plan, often cosmetic treatments.

Understanding how preventive care fits into your dental plan can help you save money and avoid unexpected expenses:

Most dental plans fully cover preventive care without requiring you to meet the deductible.

Services like cleanings, exams, and some X-rays are often provided at no extra cost.

Covering preventive care early benefits both patients and insurers by identifying issues before they worsen.

Using preventive care reduces the chance of encountering large expenses from high deductibles later.

Skipping regular cleanings to avoid a co-pay can result in more costly treatments if minor problems develop.

Family plans often come with two deductibles: one for each individual and one for the entire family. Once either limit is met, coverage levels change.

This means that in a busy household, one child’s orthodontic treatment might help meet the family deductible sooner, easing costs for other members.

Individual coverage, however, only concerns your own dental care. While simpler, it offers no sharing of deductibles among dependents. Families need to weigh both structures carefully to avoid surprises in the budget.

Dental insurance plans in 2025 maintain their familiar structure, but some updates may affect what patients pay out-of-pocket:

Core structures remain consistent. Co-pays and deductibles continue to work similarly to previous years.

Preventive care remains fully covered. Most plans still include exams, cleanings, and basic X-rays at no extra cost.

Digital tools simplify access. Online portals and real-time claim tracking make it easier to monitor deductible usage.

Patients should pay attention to whether coinsurance percentages have changed and whether out-of-pocket maximums are adjusted. Even small changes in these terms affect real-world costs.

Every plan comes with fine print. Some terms are obvious, others less so.

Small details in the fine print can significantly affect your costs throughout the year.

Here’s what patients should look for:

Check when co-pays apply. Do they start before the deductible is met, or only afterward?

Review coinsurance rules. Rates may differ depending on whether your dentist is in-network or out-of-network.

Look for preventive care limits. Some plans offer unlimited cleanings and exams, while others cap the number per year.

Read exclusions and limitations. Procedures like cosmetic treatments may not be covered at all.

Know your annual maximum. This is the total amount your insurer will pay in a year. Anything beyond that comes from your pocket.

These details may seem small, but they can add up to hundreds or even thousands of rupees in annual costs if overlooked.

While insurance can feel rigid, patients do have choices. Staying in network, using preventive services, and comparing plan structures each year are practical steps. Scheduling treatments strategically such as finishing a crown after your deductible is already met can reduce your share of expenses.

Clear communication with your dental office also helps. Many practices provide treatment estimates that break down co-pays, deductibles, and coinsurance before work begins.

Dental care costs may seem complex initially, but the key terms come down to a straightforward relationship. Deductibles determine when your insurance begins to share costs. Co-pays establish a fixed amount for many visits. Coinsurance defines the percentage you are responsible for after meeting your deductible.

By understanding co-pays and deductibles, patients can approach their next dental appointment with confidence instead of confusion. Since preventive care is fully covered in most plans, managing expenses becomes less about unexpected bills and more about thoughtful planning.

1.Do you pay a deductible every time you visit the dentist?

No, you usually pay your deductible just once each year. After that, your insurance starts helping with the costs.

2.What is a copay in dental insurance?

A copay is a fixed amount you pay when you get dental care, like $20 for a cleaning, no matter the total cost of the service.

3.Are preventive services included in the deductible?

Most times, cleanings and check-ups are fully covered and don’t require you to pay the deductible. But this can be different in some plans, so check your details.

4.Do copays count toward the deductible?

Usually, copays do not count toward your deductible. They are separate payments. Still, it’s good to check your specific plan.

5.What happens after you pay the deductible?

After you meet your deductible, insurance helps pay for your dental care. You will still pay part of the cost, often called coinsurance, until you reach your plan’s limit on out-of-pocket spending.

© MedsDental. All rights reserved 2026. Powered by MeshSq.